From estimates to final payouts

Get the facts before your next

storm claim.

At

Badgerland Restoration & Remodeling, we’ve worked with thousands of homeowners on storm damage repairs across Wisconsin, and one thing we hear over and over is: "I didn’t know how this process works!"

If you’ve ever filed a claim (or think you might need to soon), here’s a detailed breakdown of what actually happens during the insurance repair process—plus five of the most common misconceptions that trip up homeowners.

1. “I need to collect quotes before filing my claim.”

Not quite. Your insurance company will send out an adjuster to inspect the damage and write a detailed estimate for repairs. This estimate includes a breakdown of what needs to be replaced and how much your insurance company is willing to pay.

Here’s where it gets tricky:

Adjusters often undervalue the cost of repairs, or they may miss items entirely. That’s why it’s crucial to work with a contractor who has experience with insurance claims. At Badgerland, we’ve handled thousands—and we know how to spot missing items, identify underpriced repairs, and communicate directly with your adjuster to correct discrepancies.

📌 Important Note: Your insurance policy gives you the right to choose any licensed contractor you want. The insurance company can’t make that decision for you.

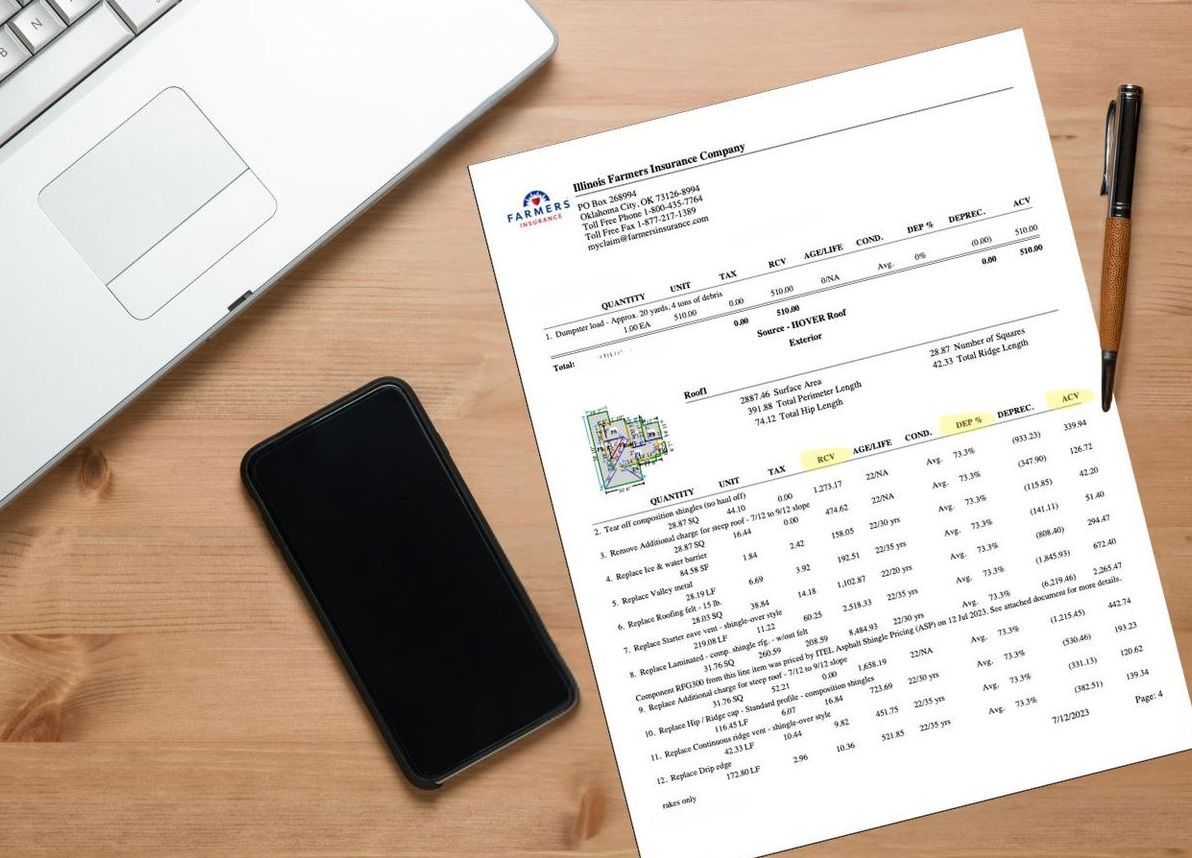

2. "I don’t understand how the payments work or what those weird abbreviations mean.”

When you receive the insurance estimate, you’ll see three main terms:

RCV (Replacement Cost Value): The total cost to replace the item with a new one.

DEP (Depreciation): The amount subtracted due to age or wear and tear.

ACV (Actual Cash Value): What the item is worth today (RCV minus DEP).

If you choose to do the repairs, here’s what happens:

Your first payment is the ACV minus your deductible.

Once repairs are complete and proof is submitted, your insurance company issues the final payment, which covers the depreciation amount.

Total payout = ACV + DEP = RCV, less your deductible.

Example: Your 20-year-old roof is damaged by hail. Your insurance company values the full replacement at $18,000 (RCV), subtracts $10,000 in depreciation (DEP), and you have a $1,000 deductible.

They’ll first pay you $7,000 (ACV minus deductible). Once the roof is replaced and documented, they’ll send the remaining $10,000.

3. “If I find someone to do the work cheaper, I get to keep the extra money.”

This is one of the most common myths—and it’s not how insurance payouts work.

Let’s say the insurance estimate values your repairs at $20,000. You find a contractor who does it for $15,000. Great deal, right?

Here’s what actually happens:

The insurance company will only pay what the job actually cost.

They’ll withhold the remaining depreciation until they see the contractor’s final invoice.

If that invoice is less than the total approved value, they just keep the difference.

Also,

if the work is done poorly, your insurance company won’t step in to fix it. Remember: you have the right to choose your contractor, but you also accept responsibility for their quality of work.

And if you skip certain repairs altogether? You’ll only receive theACV for those items—not the full replacement cost.

4. “My roof is too old—they won’t pay to replace it.”

Not true—if you have an RCV policy.

Even if your roof is 20+ years old, your insurance company must pay to replace it with a brand-new roof, including any code upgrades required by your local municipality.

The ACV might be low at first, but once repairs are completed and confirmed, the rest of the money (depreciation) will be released.

Again, the deductible still applies—but the age of your roof does not disqualify you from full coverage under an RCV policy.

5. “What’s the difference between ACV and RCV policies?”

Let’s break it down:

RCV (Replacement Cost Value): Covers the entire cost to replace the damaged item with a new one—no matter how old or worn it was.

ACV (Actual Cash Value): Only covers the current value of the item after depreciation. The older it is, the less you get.

An ACV policy might save you money on premiums, but it could cost you thousands more out of pocket when it matters most.

A 15-year-old roof with an RCV policy might be fully covered. With ACV? You might get just a few thousand—and be on the hook for the rest.

In Summary: Don’t Navigate Claims Alone

Insurance claims can be confusing, frustrating, and full of fine print. But you don’t have to go it alone.

At Badgerland Restoration & Remodeling, we help homeowners throughout Central Wisconsin understand their estimates, challenge inaccurate assessments, and ensure repairs are completed to the highest standards. We’ll even meet with your adjuster to point out damage they may have missed.

Whether you’ve just experienced hail damage or want to prepare before storm season hits, we’re here to help you every step of the way.