When Insurance Falls Short

How We Helped a Hortonville Homeowner Recover from a 2022 Hailstorm

On April 12, 2022, a severe hailstorm tore through parts of Central Wisconsin, carving a path from south of Waupaca through Weyauwega and into New London and Hortonville. As the storm subsided, it left behind a trail of extensive damage to homes, vehicles, and properties—our phones at Badgerland Restoration & Remodeling in Weyauwega, WI rang nonstop.

One of those calls came from a concerned homeowner in Hortonville. They suspected their home had sustained hail damage and asked if we could perform an inspection. Upon arrival, we confirmed what the homeowner feared: their property had suffered significant damage to the standing seam metal roof, windows, deck, and siding. We advised the homeowner to promptly file an insurance claim.

However, when the insurance adjuster's report arrived, we were shocked. The damage to the roof and windows—both obvious and severe—had been excluded entirely. The proposed settlement amount for the rest of the damage was not only incomplete but drastically undervalued at just $17,800.

Unfortunately, this situation is all too common. It’s in these moments that our decades of experience in storm restoration and insurance claim support make all the difference.

We immediately stepped in to advocate for our client, meeting directly with the insurance adjuster to present clear evidence of the damage. While the adjuster did revise the estimate to $27,300 after our involvement, he remained firm on excluding the metal roof and much of the other obvious damage.

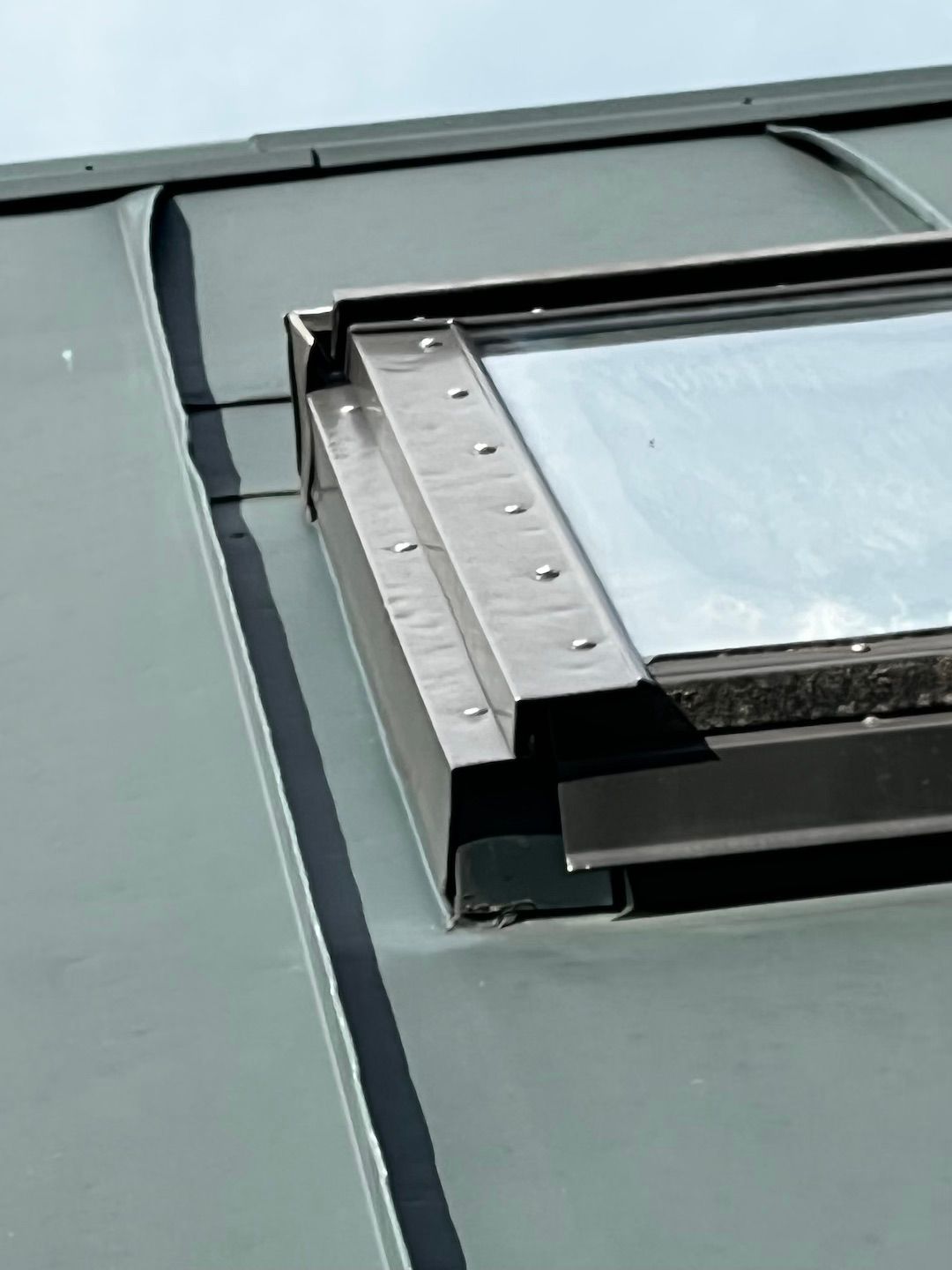

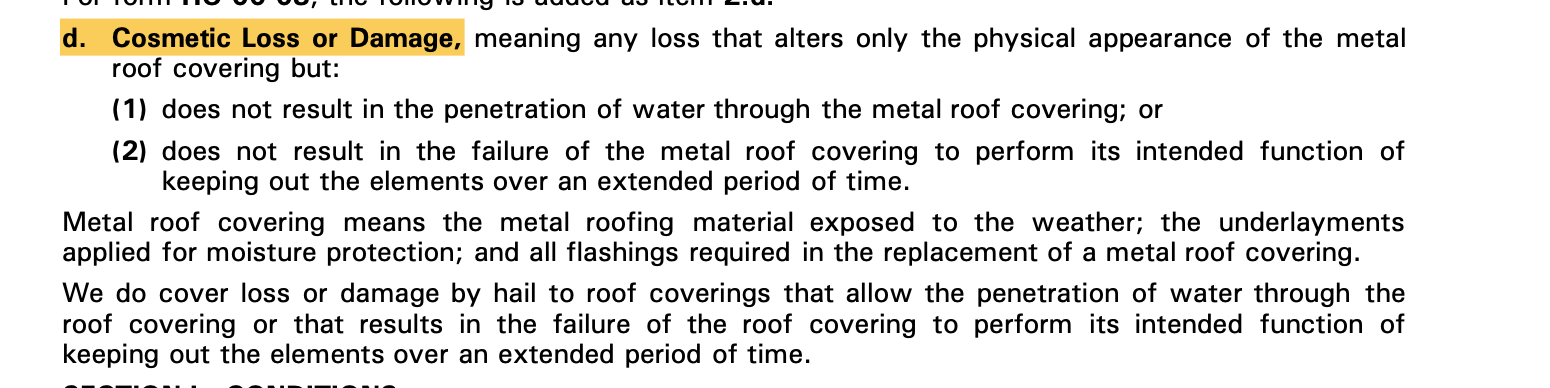

In this particular case, the homeowner's policy included a “metal cosmetic damage exclusion”—a clause that denies coverage for hail dents and dings unless they result in water intrusion. This exclusion applies to metal roofs, gutters, vent pipes, skylight flashings, and other metal elements. It’s an important reminder to homeowners: know what your policy actually covers and doesn't cover.

Photos of hail damage of another customer's metal roof denied as "Cosmetic Damage".

We’ve seen many homeowners discover too late that this exclusion was buried in their policy. When hail strikes, cosmetic damage to metal may look minor but often results in significant depreciation in property value, not to mention potential future issues. And replacing metal elements isn't cheap.

In this Hortonville case, while the roof was not covered, we strongly believed that the damage to the windows warranted full replacement. The hail had compromised their structural integrity, reducing their lifespan and making the home vulnerable to water intrusion, condensation, and mold. We were confident this was not just a cosmetic issue—it was a functional one.

When negotiations stalled, we moved to the next step: invoking the appraisal clause.

Most homeowners don’t realize they have the right to demand an appraisal if they believe their insurance payout is unfair. An appraisal brings in a neutral third party to evaluate the damages and the estimates submitted by both the insurance company and the contractor. In many cases, this impartial review leads to a fair resolution.

That’s exactly what happened here.

The appraiser sided with our assessment. They agreed that the windows needed full replacement. They also acknowledged that the insurance company had undervalued the cost of repairing the deck and replacing the home’s siding. The final award was $66,300—an increase of $48,500 from the original quote.

This battle wasn’t quick. It took nearly three years of persistence, documentation, and advocacy. But in the end, the homeowner received the compensation they were rightfully owed.

Click bellow to see more photos for this project

At Badgerland Restoration & Remodeling, we see these types of claims far too often—homeowners overwhelmed, underpaid, or outright denied. Many walk away thinking there’s nothing more they can do.

But you can fight back. And you don’t have to do it alone.

We’ve worked with thousands of homeowners across Wisconsin, helping them navigate complex claims and get the fair outcomes they deserve. If you’re dealing with storm damage and not getting the answers—or coverage—you need from your insurer, let our experienced team stand by your side.

Badgerland Restoration & Remodeling: Insurance Claims Experts.

Always on Your Side.

Follow us!